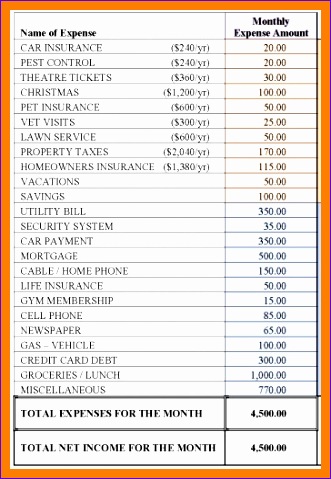

For example, according to the Family Budget Calculator created by the Economic Policy Institute, a single person living in Franklin County, Missouri, would need to spend an estimated $2,766 a month to live modestly yet comfortably. Included in this cost is $516 a month for housing, $241 for food and $309 for health care. The average monthly expenses for a single person depend on where they live and how they live. What Are the Average Household Monthly Expenses for a Single Person? Even your daily cup of coffee can add up to hundreds of dollars a year. Make sure to list small purchases, too, like eating out for breakfast a few times a week. This includes items you buy every day, monthly bills and things you only get occasionally. When creating your home’s budget, you’ll need to write down every expense you can think of, which may not be included in the list above. Census Bureau of Labor Statistics, American households typically have the following costs:

According to the 2019 Consumer Expenditure Survey conducted by the U.S. Household expenses are unique to each family and individual. Still, most households have some costs in common, like groceries and utilities. Having a budget will help you spend money wisely and stay out of debt.

#TYPICAL MONTHLY EXPENSES HOW TO#

Lastly, we’ll show you how to use your list of household expenses to form a budget. You can also use this information to compare your spending to national averages, which can help you determine if you need to cut back. In this chapter, we’ll share a list of common household expenses and how much a person spends on average to pay their monthly bills, so you know what to expect. You need to know what your daily and monthly household expenses look like to create a budget for your new home. Your household expenses also include how much you spend on entertainment and miscellaneous items. Household expenses cover everything you spend to maintain your house and meet your family’s needs, from your mortgage payments to education costs. This, in turn, allows you to focus on finding ways to cut costs or increase your income so you can pay all of your bills each month and even start saving for the future.Chapter 1: Average Cost of Household Expenses Prioritizing bills and expenses in order of importance lets you meet basic needs, protect your credit, and lower your financial stress. If you find that you don't have enough money left to make these payments after paying for your monthly expenses, contact your lender as soon as possible to negotiate a more affordable repayment plan. If you miss payments, your lender may eventually be forced to repossess these items. Remember that some debts, like mortgages and car payments, are secured loans and are tied to your house or car. Luckily, there are a number of websites that let you access your credit report for free.

#TYPICAL MONTHLY EXPENSES FULL#

A record of late or missed payments could stop you from borrowing money or getting a place to live in the future, so it's a good idea to look at your credit report on a quarterly basis to get a full picture of all the money you've borrowed from lenders. Once you know your "must pay" monthly expenses, focus on paying any bills that could impact your credit, including debt from credit cards and loans. The expenses left are your "must pay" expenses for the month. Go through each expense on your list and make a note of any you can delay payment on or change for a brief period.

There are probably items on your grocery list that can be removed to save money for other bills that month. Your food budget is a great example of an expense that is both a priority and something that you can adjust if you have more pressing bills to pay. If you pay for utilities, like heating and water, you may have a month or more to make your payment before having your service disconnected. Paying for shelter should always be the first priority, so you continue to have a roof over your head. This is where prioritizing, or deciding what to pay first, comes in. You probably have bills for some (or all) of the things on your monthly expense list, but you may not have enough money to pay all of them.

Although it's important to try to make all of your monthly payments, it may not always be possible. It can be tough to decide which bills and monthly expenses to pay first, especially if you're on a tight budget.

0 kommentar(er)

0 kommentar(er)